Have you tried to fix it with a Journal Entry and discovered the payments are still showing up to be deposited? (you can’t fix Undeposited Funds properly with a Journal Entry in QuickBooks). Save time, money, and your sanity when you let ReliaBills handle your bill collection, invoicing, reminders, and automation.. When business is thriving, bookkeeping has a way of sneaking up on you.

I have payments that are no longer in my bank feed, but they’re still showing up

Learn how to put payments into the Undeposited Funds account before you combine them into a deposit. Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction. It’s good to periodically check your Undeposited Funds account and clear out any payments waiting to be moved.

Use the Undeposited Funds Account Correctly

QuickBooks moves the money from Undeposited Funds into your bank account, just like your actual bank deposit. All payments in the Undeposited Funds Account will automatically appear in the Bank Deposit window. You will see Undeposited Funds as the default “Deposit to” account when you receive payments from invoices, use a payment item on an invoice, or enter a sales receipt. Remember, it’s essential to regularly review, organize, and reconcile your financial records to ensure their accuracy and integrity. If you encounter any discrepancies or have specific questions, consult with a professional accountant or refer to the QuickBooks Online resources for further guidance.

Start using the Undeposited Funds account

Whether you are new to QuickBooks Online or looking to optimize your bookkeeping workflow, this guide will equip you with the knowledge and tools to effectively manage and clear undeposited funds. As for the article about categorizing my entries, I have multiple screens and was trying to type on my second screen and didn’t realize I hadn’t clicked on it. I’m here to help you remove the duplicate PayPal fees so you can reconcile your accounts accurately in QuickBooks Online, Dawn_at_Throw_Pink. I can tell that those PayPal transactions were categorized to the Undeposited Funds account.

- As for the article about categorizing my entries, I have multiple screens and was trying to type on my second screen and didn’t realize I hadn’t clicked on it.

- In other words, what you see on your bank statement does not match what you see on your itemized bank deposit slip.

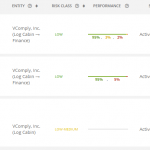

- Review the list to confirm that the payments you selected for the bank deposit no longer appear in the undeposited funds account.

- The technical accounting of the record deposits function is credit undeposited funds and debit cash or checking.

- Once you have reviewed and organized your transactions in the undeposited funds account, it’s time to create a new bank deposit in QuickBooks Online.

Receiving payments and depositing to Undeposited Funds

You don’t need to combine downloaded transactions or use Undeposited Funds since QuickBooks already has the info from your bank. Has a balance in the Undeposited Funds account on your balance https://www.simple-accounting.org/ sheet ever caused you to double-post customer payments or overstate cash? This feature can be confusing to QuickBooks users who may not realize where the balance is coming from.

Have you ever been in your Chart of Accounts and noticed Undeposited Funds? It’s possible that you’ve seen it many times without knowing much about it, or when you should use it. Well, get ready to learn something new and take a thorough look at Undeposited Funds. For example, if you need to provide additional information or https://www.accountingcoaching.online/accrual-basis-accountingtools/ notes about the deposit, like the source of the funds, you can add those details in the memo or notes section of the transaction. For us to correct this, let’s make sure to properly categorize your expenditures to a special expense account so that you may consider consulting your accounting expert to book it accordingly.

Select all the payments you will include in the deposit, making sure the amount you record in QuickBooks Online matches the amount on your bank deposit slip. Also, be sure you are posting the deposit to the correct account — in this case, checking — and that the date on the transaction is the date you will take the deposit to the bank. For example, let’s say Willie’s Widgets paid you $300, Wally’s Whatsits paid you $750 and Whitley’s Whosits paid you $200. However, you need to properly credit each customer for their payment.

Now, let’s move on to the steps to clear undeposited funds in QuickBooks Online. Promptly reviewing and applying customer payments in QuickBooks is crucial for maintaining accurate cash flow and financial records, reducing the risk of undeposited funds. This step is crucial for maintaining the financial how to void a check integrity of the business and preventing any potential errors that may arise from misrecorded or omitted deposits. In addition, reconciling bank deposits in QuickBooks helps in providing a clear and reliable overview of the company’s financial health, aiding in making informed business decisions.

After recording the bank deposit in QuickBooks Online, it’s important to take the final step of verifying that the undeposited funds have been cleared. This ensures that all the selected payments have been appropriately moved from the undeposited funds account to the bank account, and your records are accurate. Think of the undeposited funds account as a virtual cash register or a temporary safe where you can store customer payments until you’re ready to deposit them. This feature is especially beneficial if you receive multiple payments throughout the day or week and want to combine them into one bank deposit. By understanding the importance of clearing undeposited funds, you can maintain accurate financial records and stay on top of your business’s cash flow.

Undeposited funds in QuickBooks refer to payments received from customers that have not yet been deposited into the company’s bank account. Clearing undeposited funds in QuickBooks Online is a vital task to ensure the accuracy and integrity of your financial records. By understanding how undeposited funds work and following the step-by-step process outlined in this guide, you can confidently manage and clear undeposited funds in your QuickBooks Online account. Once the bank deposit is saved, QuickBooks Online will create a new transaction to represent the actual deposit into your bank account. This transaction should reflect the details you entered when creating the bank deposit, such as the date, deposit to account, and amount. Once you are confident that all the information in the bank deposit form is accurate, you can proceed to finalize the deposit.

Making any necessary adjustments at this stage will help avoid complications and errors during reconciliation. Now that we understand what undeposited funds are and why they’re useful, let’s explore why it’s crucial to clear undeposited funds in a timely manner. In this guide, we will walk you through the steps to clear undeposited funds in QuickBooks Online. We will explain the concept of undeposited funds and why it is important to clear them.

Let’s look closer at what the Undeposited Funds Account in QuickBooks is. You’ll also notice that when you click on the deposit, it expands and you can choose to edit. This is the convenience of this special account I know you’ll learn to love.

If you’re depositing your checks one at a time, which is often the case for smaller businesses, you have to keep careful track of each and every deposit. However, when you use the undeposited funds account, you can record the specific checks in your software and not have to come back to them later to find out which is which. Double-check that the deposit to account in the transaction matches the appropriate bank account where the funds were actually deposited. This will facilitate accurate reconciliation with your bank records. The special account enables you to combine multiple transactions into one record in the same way your bank has combined all the transactions into one record.